Explain the Journal Entry Method of Recording End-of-period Adjustments

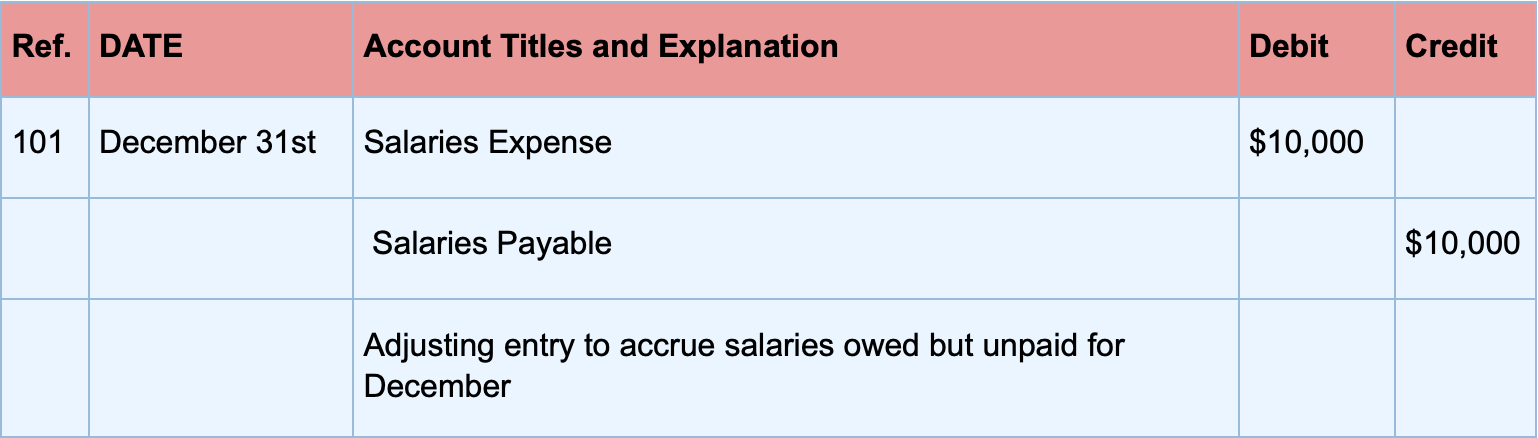

Accountants record these journal entries in the general ledger accounts and usually prepare them at the end of the financial year after the preparation of a trial balance. Adjusting entries for accruing unpaid expenses.

Bookkeeping Vs Acc Accounting Process Accounting Basics Bookkeeping Business

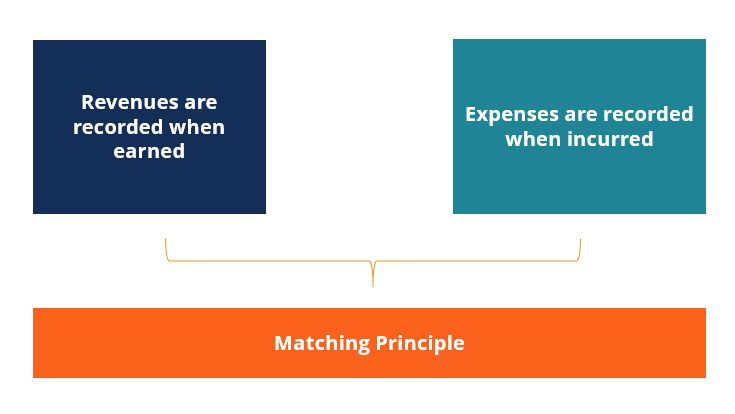

So these accounts must be updated for matching incurred expenses against the revenue of the period.

. Finally when you record a prior period adjustment disclose the effect of the correction on each financial statement line item and any affected per-share amounts as well as the. End-of-period-adjustments apply the matching principle of accounting which include accruals deferrals and asset value adjustments. Determine what current balance should be.

Determine current account balance. On December 31 an adjusting journal entry is made because it is the end of an accounting period and MicroTrain has not used all of the insurance they paid for. If we know the Journal entry we can identify the effect of the same on the ledger accounts and thus be able to identify the adjustments to be made.

Define an adjusting journal entry. One of the steps in an accounting cycle is the process called adjusting entries. These adjustments are then made in journals and carried over to the account ledgers and accounting worksheet in the next accounting cycle step.

A remove the earned amount to a revenue account b remove the unearned amount to a liability account c increase the cash account at period-end. In each case the periodic inventory system journal entries show the debit and credit account together with a brief narrative. See the answer explain the journal entry method of recording end-of-period adjustments.

Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle in accounting. The Trading ac Profit Loss ac and the Balance Sheet. Adjusting entries update accounting records at the end of a period for any transactions that have not yet been recorded.

In general there are two types of adjusting journal entries. Year-end adjustments are journal entries made to various general ledger accounts at the end of the fiscal year to create a set of books that is in compliance with the applicable accounting framework. The general formula to compute cost of.

Prior period adjustments are adjustments made to periods that are not current period but already accounted for because there is a lot of metrics where accounting uses approximation and approximation might not always be an exact amount and hence they have to be adjusted often to make sure all the other principles stay intact. An adjusting journal entry is made at the end of an accounting period to reflect a transaction or event that is not yet recorded. Every adjusting entry involves a change in revenue or expense accounts as well as an asset or a.

Using Quickbooks Accountant 2014 13th Edition Edit edition Solutions for Chapter 9 Problem 1Q. Adjusting entries follows the accrual principle of accounting and make necessary adjustments which are not recorded during the previous accounting year. The ending inventory is determined at the end of the period by a physical count and subtracted from the cost of goods available for sale to compute the cost of goods sold.

Thanks Best Answer 100 1 rating Adjusting entries are recorded at the end of an accounting period to adjust ledger accounts for any changes that relate to the current accounting peri. Which of the following lists of assets would be classified as plant assets. Unpaid expenses are expenses which are incurred but no cash payment is made during the period.

One important accounting principle to remember is that just as the accounting equation Assets Liabilities Owners equityor common stockor capital must be equal it must remain equal after you make adjusting entries. By the end of this course you will be able to. The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses.

According to matching principle the expense must be matched against recognized revenue. MicroTrain will record an adjusting entry for 1 month of insurance expense 2400 12 months since the policy began December 1 and the year end is December 31. Such expenses are recorded by making an adjusting entry at the end of accounting period.

But at the end of the fiscal year some of the accounts are recorded without any changing. The Accounting Equation 3 The Double-entry Framework 4 Journalizing And Posting Transactions 5 Adjusting Entries And The Work Sheet 5A Depreciation Methods 6 Financial Statements And The Closing Process. 1 Introduction To Accounting 2 Analyzing Transactions.

Recording AJEs is quite simple. A number of year-end adjustments may be required depending on how diligently the books have been maintained on a monthly basis. The adjustments are made at the time of making up the final accounts within the three parts that make up the final accounting ie.

An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Here are the three main steps to record an adjusting journal entry. At the end of the period the total in purchases account is added to the beginning balance of the inventory to compute cost of goods available for sale.

Solutions for problems in chapter 9. Adjusting entries are booked before financial statements are released. -Define accounting and the concepts of accounting measurement -Explain the role of a bookkeeper and common bookkeeping tasks and responsibilities -Summarize the double entry accounting method -Explain the ethical and social responsibilities of bookkeepers in ensuring the integrity of financial.

End-of-period-adjustments in accounting Background to end-of-period-adjustments in accounting. End-of-period adjustments are also known as year-end-adjustments adjusting-journal-entries and balance-day-adjustments. An alternative to recording a prepayment of revenue initially as a revenue as opposed to a liability requires a period-end adjusting entry to.

View the full answer Previous question Next question. It is a result of accrual accounting Accrual Accounting In financial accounting accruals refer to the recording of revenues that a company has earned but has yet to receive payment for and the and follows the matching and. Explain the journal entry method of recording end-of-period adjustments.

If you are making a prior period adjustment to an interim period of the current accounting year restate the interim period to reflect the impact of the adjustment. The periodic inventory system journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting under a periodic inventory system. Accounting of Adjusting Journal Entries.

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Adjusting Entries Guide To Making Adjusting Journal Entries Examples

No comments for "Explain the Journal Entry Method of Recording End-of-period Adjustments"

Post a Comment